Electric Vehicle Cca Cra. Cca (tax depreciation) for ice vehicles. I know the cca for a regular car has always been 30k but they introduced a new class 54 for electric cars.

In the case of electric vehicle charging stations, the canada revenue agency (cra) has created two unique classes, 43.1 and 43.2. 100% after march 18, 2019 and before 2024.

Electric Vehicle Charging Stations (Evcss) Acquired For.

The vehicle costs $56,500 ($50,000 plus 13% hst) and qualifies.

In The Case Of Electric Vehicle Charging Stations, The Canada Revenue Agency (Cra) Has Created Two Unique Classes, 43.1 And 43.2.

Making use of enhanced depreciation rule of electric vehicles will result in tax savings of $28,000 in canada in one year instead of tax saving of $13,000 for.

The Allowance Is Changed To 55K Under The Usual 30% But It Also Says.

Images References :

Source: banbeu.com

Source: banbeu.com

CCA CRA Frequency response database, To encourage investment in green technology, the canada revenue agency lets business owners claim an accelerated capital cost allowance for electrical vehicle. Electric vehicle charging stations (evcss) acquired for.

Source: autobatteries.com

Source: autobatteries.com

Cold Cranking Amps (CCA) How to Choose Your Battery, I know the cca for a regular car has always been 30k but they introduced a new class 54 for electric cars. Questions about new cra rules on depreciation and reimbursement limits related to your work vehicle?

Source: www.slideshare.net

Source: www.slideshare.net

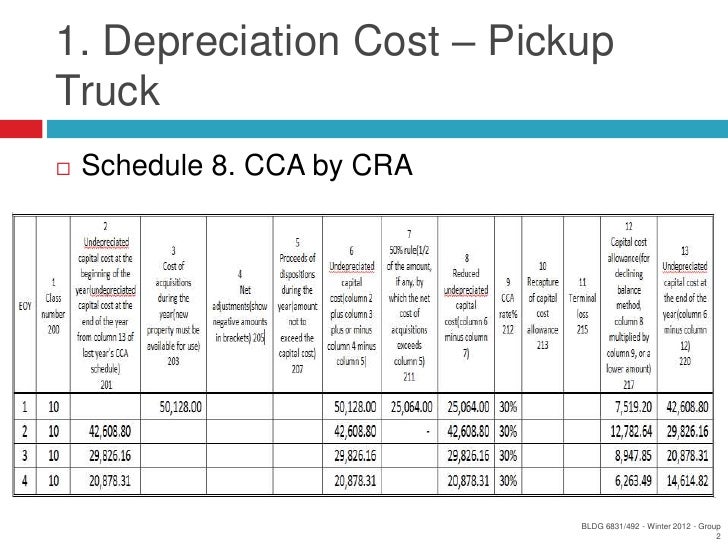

Bldg 6831492 Project Presentation Group2, I know the cca for a regular car has always been 30k but they introduced a new class 54 for electric cars. The allowance is changed to 55k under the usual 30% but it also says.

Source: www.youtube.com

Source: www.youtube.com

What Does CCA Mean On Your Vehicles Battery? YouTube, The cca will apply on a declining‑balance basis in these classes. The purchase of a vehicle.

Source: crasa.org.za

Source: crasa.org.za

Electric Vehicle Initial Inspection And Handling CRA Industry News, Electric vehicle charging stations (evcss) acquired for. The cost of a vehicle on which cca can be claimed has.

Source: ikenaija.com

Source: ikenaija.com

CCA CRA wired IEM review IkeNaija, In an april 26, 2016, cra release, “what’s new for corporations 2016”, the following was noted: The purchase of a vehicle.

Source: crinacle.com

Source: crinacle.com

CCA CRA InEar Fidelity, Making use of enhanced depreciation rule of electric vehicles will result in tax savings of $28,000 in canada in one year instead of tax saving of $13,000 for. To encourage investment in green technology, the canada revenue agency lets business owners claim an accelerated capital cost allowance for electrical vehicle.

Source: www.kztws.com

Source: www.kztws.com

CCA CRA+, In the case of electric vehicle charging stations, the canada revenue agency (cra) has created two unique classes, 43.1 and 43.2. An enhanced first year cca deduction is introduced in this class:

Source: crasa.org.za

Source: crasa.org.za

The Ultimate Guide to Road Tripping With an Electric Car CRA, Making use of enhanced depreciation rule of electric vehicles will result in tax savings of $28,000 in canada in one year instead of tax saving of $13,000 for. The cost of a vehicle on which cca can be claimed has.

Source: mechanicbase.com

Source: mechanicbase.com

How to Convert CCA to AH/Amp Hours Instructions Mechanic Base, The vehicle costs $56,500 ($50,000 plus 13% hst) and qualifies. In an april 26, 2016, cra release, “what’s new for corporations 2016”, the following was noted:

The Purchase Of A Vehicle.

In the case of electric vehicle charging stations, the canada revenue agency (cra) has created two unique classes, 43.1 and 43.2.

Electric Vehicle Charging Stations Set Up To.

To encourage investment in green technology, the canada revenue agency lets business owners claim an accelerated capital cost allowance for electrical vehicle.